georgia ad valorem tax exemption form family member

Georgia Tax Center Help Individual Income Taxes Register New Business. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of.

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status

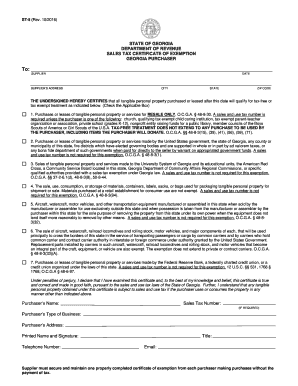

This form is to be used by a Motor Carrier to apply for exemption from Title Ad Valorem Tax.

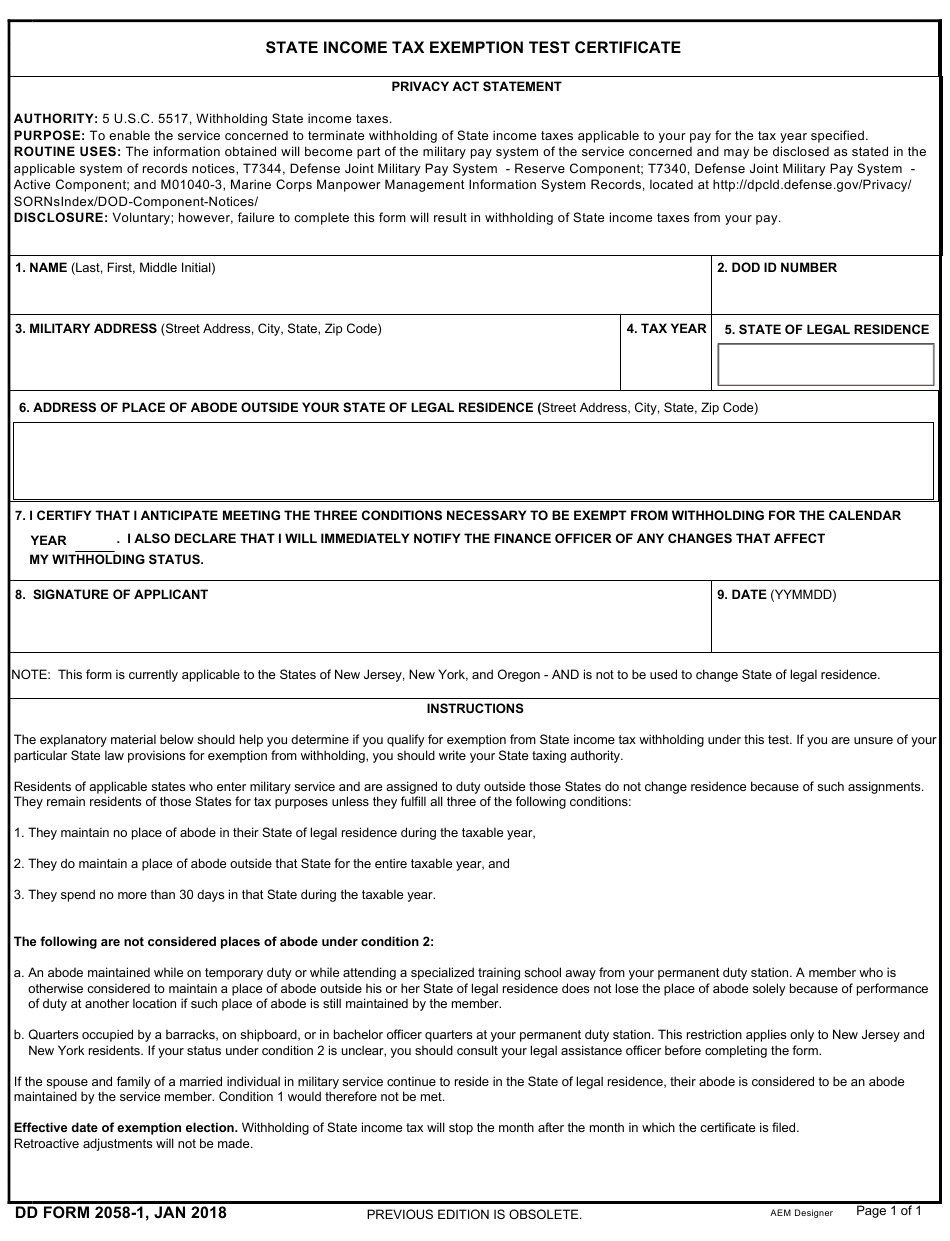

. Georgia Department of Revenue SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES Form PT 471 122010 I _____ _____ Full Legal Name Service Members Number do hereby solemnly swear or affirm that. Get the estimated TAVT tax based on the value of the vehicle using. Vehicles purchased on or after March 1 2013.

Any Ad Valorem Tax due on the above items is payable to the taxing authority of my home countrystate listed above. GDVS personnel will assist veterans in obtaining the necessary documentation for filing. TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations Georgia Trucking Portal.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Title Ad Valorem Tax TAVT - FAQ.

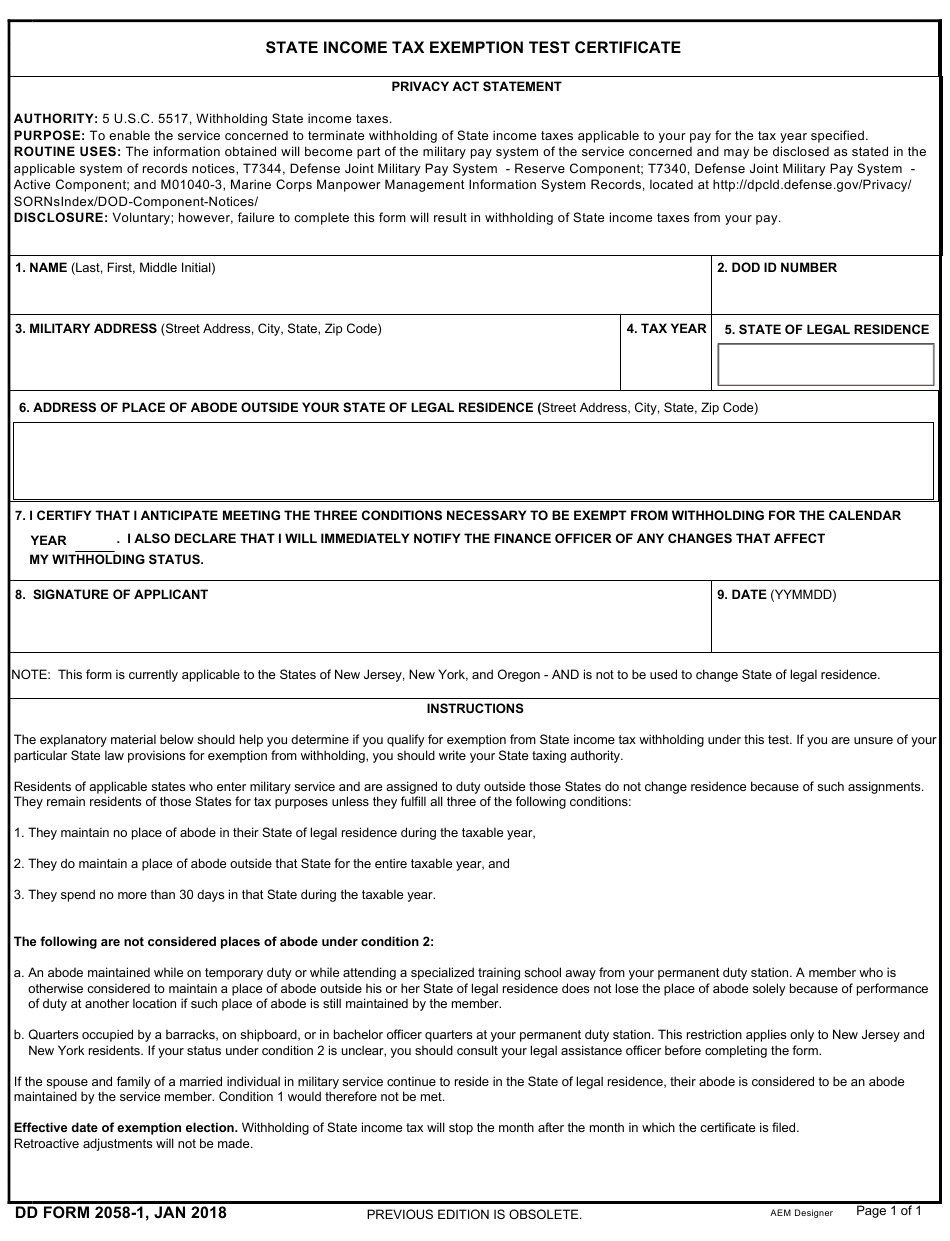

This tax is based on the value of the vehicle. Facebook page opens in new window. To qualify you must have a home of record in another state be stationed in Georgia and you cannot already have a homestead.

Free shipping on international orders of 120 English. The family member who is titling the vehicle is subject to a 05 title ad valorem tax. HB 1302 Tax Refund.

How does TAVT impact vehicles that are leased. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT depends on whether you as the former owner of the vehicle have already paid the TAVT.

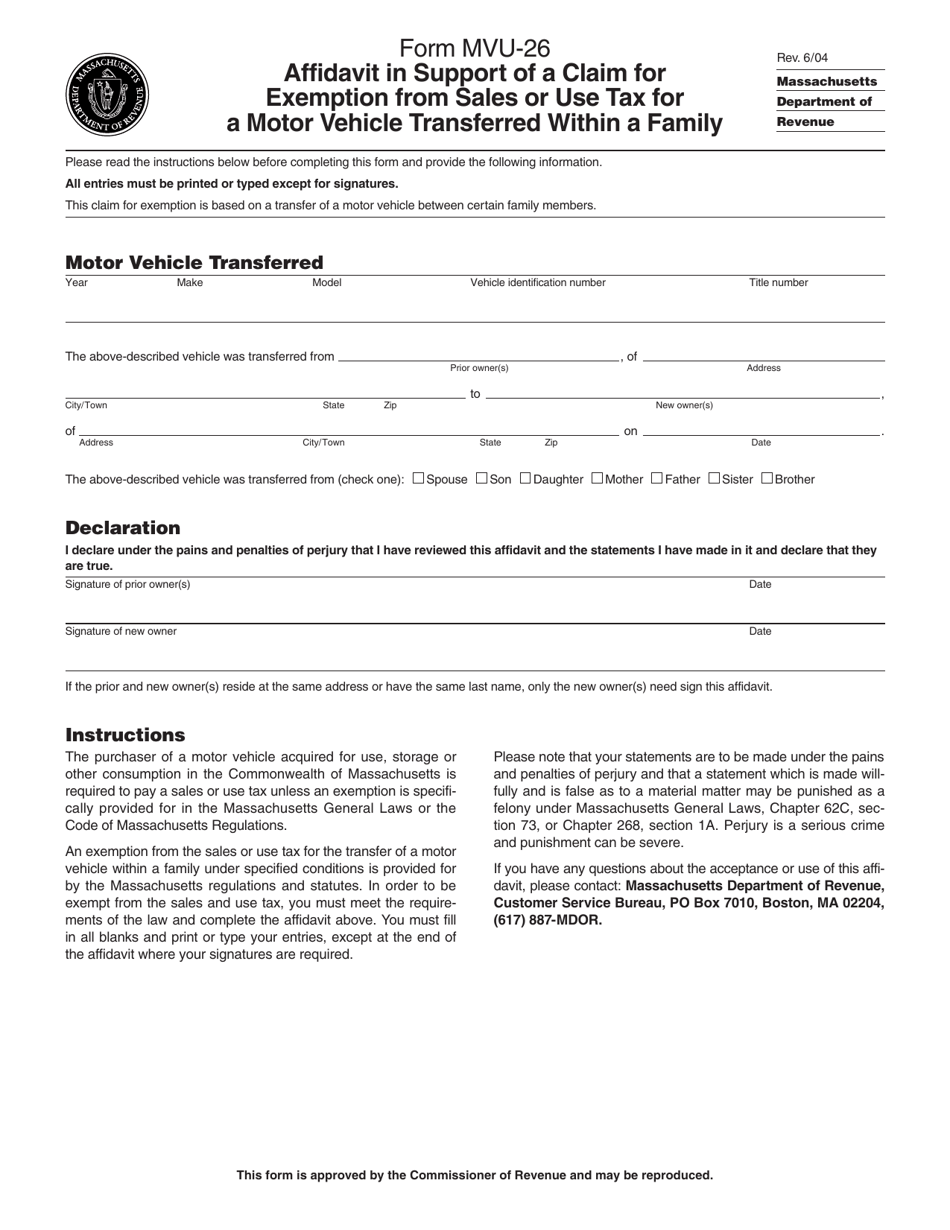

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. MV-16 Affidavit to Certify Immediate Family Relationship. If you are in the military active duty and stationed in Georgia you may request exemption from Annual Ad Valorem Tax using a Military Annual Ad Valorem Tax Exemption PT-471 form and certification from your Commanding Officer.

The actual filing of documents is the veterans responsibility. Void After 60 Days Void If Altered. Attach a copy of paid receipt if applicable and copy of LES.

Continue to pay annual ad valorem tax on. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. The tax must be paid at the time of sale by Georgia residents or within six months of.

PT-471 Service Members Affidavit For Exemption of Ad Valorem Taxes For Motor Vehicles. I am aware that I must be stationed in the state of Georgia and live in the State of Georgia to quality for this exemption. How to submit this form.

Kemp has signed HB 1302 allowing for an income tax refund due to a revenue surplus. T-146 Georgia IRP Exemption to State and Local Ad ValoremTitle Ad Valorem Tax Fee Application. ApplicantMotor Carrier attests that Georgia sales and use tax is paid unless exempt under Article 8.

The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. The dealership is responsible for paying the title ad valorem tax and may include this cost in the. If you the former owner have not paid the TAVT and are paying annual ad valorem tax on the vehicle your immediate relative has two options.

This form must be completed in its entirety legibly printed in blue or black ink or typed and submitted along with the. Read the FAQs for more information. New residents to Georgia pay TAVT at a rate of 3.

Georgia Tax Center Help Individual Income Taxes Register New Business. Georgia Trucking Portal Forms Alcohol Tobacco Alcohol Tobacco Enforcement Excise Taxes Online Services. Family transfer - Form MV-16 Affidavit to Certify Immediate Family Relationship required.

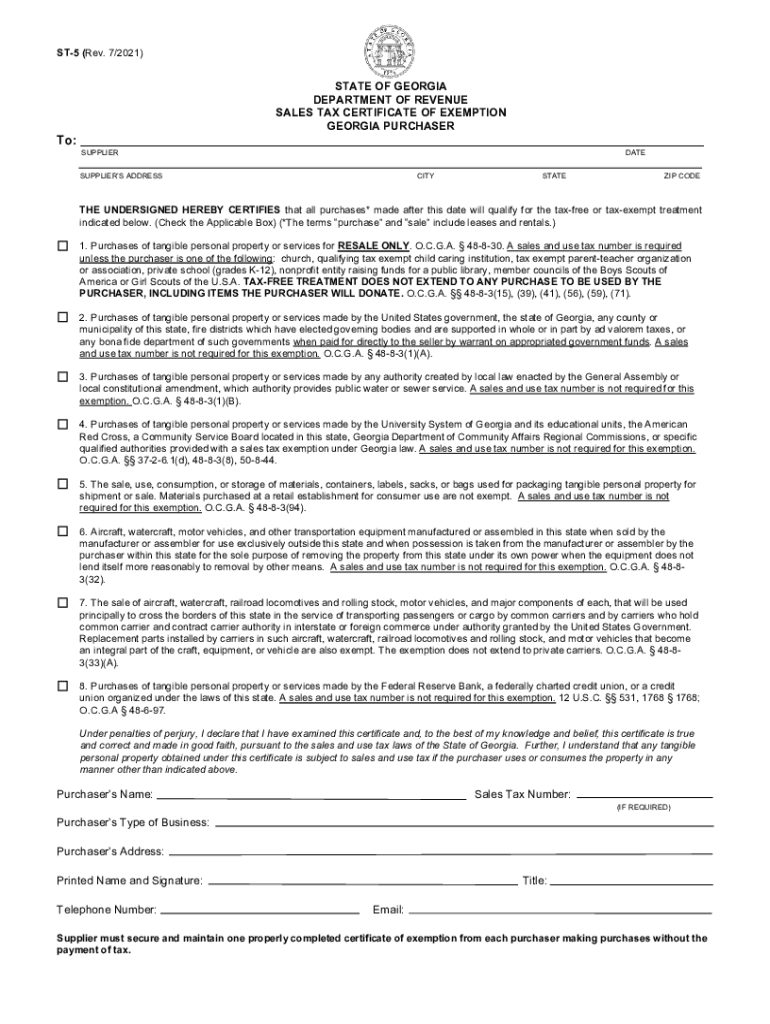

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

2022 Update Houston Homestead Home Exemptions Step By Step Guide

Quit Claim Deed Pdf Quites Quitclaim Deed Words

What Is A Homestead Exemption And How Does It Work Lendingtree

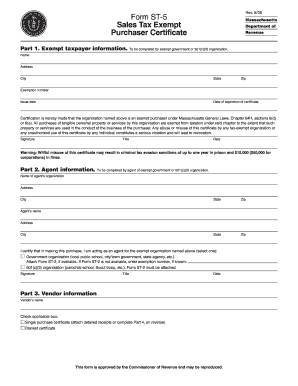

Ma Tax Exempt Fill Out And Sign Printable Pdf Template Signnow

Gsccca Org Pt 61 E Filing Help

2022 Update Houston Homestead Home Exemptions Step By Step Guide

Form Mvu 26 Download Printable Pdf Or Fill Online Affidavit In Support Of A Claim For Exemption From Sales Or Use Tax For A Motor Vehicle Transferred Within A Family 2004 Templateroller

2021 Form Ga Dor St 5 Fill Online Printable Fillable Blank Pdffiller

Sample Tax Exemption Doc Template Pdffiller

Application For Work Permit Ohio

Delaware Small Estate Affidavit Form Estates Delaware Small

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Dd Form 2058 1 Download Fillable Pdf Or Fill Online State Income Tax Exemption Test Certificate 2018 Templateroller